This page looks at property from the perspective that you want to make money out of it, and not for living in. Think of yourself now as a property investor.

The information here is split into two parts. Our own review of what you can do and think about with property; and our immediate recommendation. Yes, it’s a good idea but go to a free training event to find out much more about what is possible. In the UK we recommend:

Side Income opportunities come from property in two primary ways:

- Renting the property out.

- Selling property for a profit.

Rental Income

Your purpose with owning or controlling a property and renting it out is to generate more money than costs and produce a regular monthly income.

Income from a sale

Your purpose from selling a property is to generate a one off lump of money which allows you to move ahead with other plans.

What is the earnings potential?

There is no straight forward answer to this question. Some of the richest people in the world have built that wealth on the back of property ownership.

Renting out a single fairly standard two or three bedroom house you should be aiming to make at least £200-250 per month on top of any costs, and much more if your property is in London or other high price areas. That’s £2,500+ annually for controlling a property which for large periods of time will just tick over in the background. But it could be several times that amount.

If you flip a property it depends on so many other things, location, type, upkeep of property etc. TV programmes like Homes under the Hammer will give you a feel for what some people make. It can be eye wateringly large amounts.

Is it legal?

Yes of course it’s legal, lots of people buy and sell houses every year.

Doing it as a Side Income earner as a landlord or for flip, you must make sure you have got the legal side right. It shouldn’t put you and a good solicitor and accountant will guide you through it.

How easy is it to do?

Owning a property is relatively easy. Making a sustainable income from it does require you to identify a strategy which suits you, your lifestyle and your budget.

The primary concerns over pursuing property from a Side Income perspective are:

- Understanding how much time you have to put into this.

- Knowing your budget.

- Identifying what type of property you want to become involved in.

- Understanding the tripwires.

- Understanding your area and market. This includes a realistic idea of how property prices may change over the next 3-10 years.

Time

Some investors buy properties which are already let and producing an income. In which case your only time concern is how long it takes you to find and buy the property.

If you inherit a property you have immediate control over it and your time concern is now how long it takes you to conduct and renovation required or how long it takes to sell.

If you are seeking to get into property there will be a search and then purchase period. Although it’s not impossible to go faster, from cold you should allow at least six months and some take years.

In all timing cases we tend to be over optimistic. If you think something will take a certain number of weeks, test your finances and ability to support the project if that time doubles, triples or even quadruples.

Your Budget

There are ways in which you can gain control, if not ownership, of a property for only £1 but this requires specialist knowledge from experts.

Most normally you will be seeking to use money to buy a property. If you are a cash buyer, ie don’t require a mortgage, then as long as you have the money you should be fine.

If you require financial support in the form of a mortgage or in some cases a bridging loan, ensure that you fully understand what your monthly and annual costs will be and that they are stress tested against a rise in interest rates.

In terms of any renovation or maintenance costs, we once more tend to be overly optimistic. Try to list out all of your expected costs, get written quotes from builders and tradesmen, and then assess how you will cope if all costs double.

What do you mean, “What type of property”?

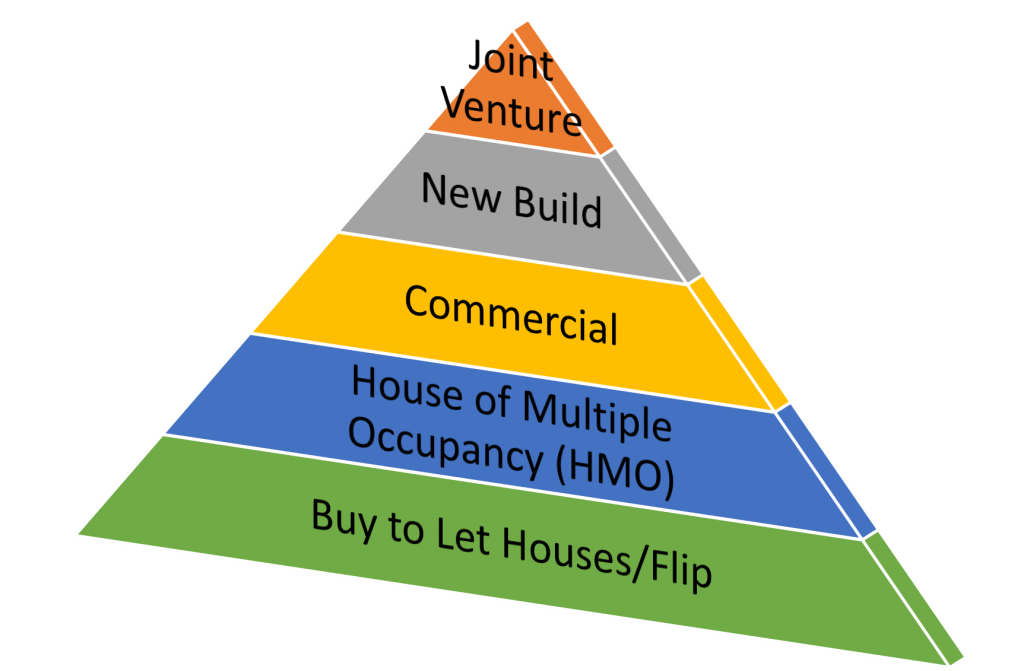

It is really easy to start out into property thinking only of houses or single family dwellings. They are the basic commodity, if you like, but there are many different types of property from which you can make an income.

If you want to find out more about each property type please send us an email or sign up for the updates and we will provide additional information.

Tripwires and Pitfalls

Every property developer or investor has come across problems. It is likely that any property you are developing from a Side Income perspective will be highly significant to you and so each trip or fall will feel very personal and can drain you emotionally. Beware its not all a straight ride.

Unexpected work

On my first project a step ladder I was standing on literally fell through the floor. We hadn’t identified a woodworm problem before purchase and suddenly found ourselves having to replace floors and joists, and use woodworm repellent around the whole building.

On most renovation or refurbishment projects there will be unexpected jobs. These will impose additional time and finance constraints on you.

Unexpected work may cover more repairs than planned but could also include the need for local authority approval, planning permission, providing more financial information to lenders and dealing with accidental damage.

Whenever you’re about to start a project always give yourself a contingency of time and budget. You will probably use both.

Building your Team

Unless your property is perfect, and non are, you will need to develop a team of skilled people to help you. These will include:

- A solicitor.

- Surveyor.

- Builder.

- Bricklayer.

- Plumber.

- Electrician.

- Roofer.

- Lawyer.

- Plasterer.

- Tiler.

- and Joiner.

You may get the right people first time but you will need to find a team that understands you and what you want.

Know your Area

I have had many conversations with people starting with, “If this property was in London it would be …”. It’s nice to know what your property might be worth in the capital, but your real need is to know what it will be worth where it actually is.

Spend time understanding your area, what price ceilings are for purchase and rental prices, what is expected from a property, where new developments are going to occur, and if there are areas to avoid.

Rightmove is a good start place for understanding prices but beware that it doesn’t tell you everything and you do need to invest some time into learning about your area, road, street, and property type.

Visit your local estate agents, chat to them, become their friend. View as many properties as you can to get the feel of what standard of properties are available within your price band.

Estate Agents aren’t the only buying option.

99% of people will buy and sell their property through estate agents, but rest assured, they aren’t the only option. That’s where all your competition goes to look as well. which means that you are likely to have to pay market price for the property.

If you see property as an income stream then you ideally want to pay below market price.

Ways in which you can do this are:

- Buying at Auction.

- Buying directly from a seller who has not advertised the property.

- Finding a seller who wants to get rid of their property quickly for a variety of reasons.

- Leasing a property initially before purchase.

Our Recommendation

Property is an excellent way to build a strong side income. It can also be highly stressful and eat through all of your resources.

If you are thinking about getting into property read about how others have done it, watch any of the multitude of the TV programmes on it and go to a free property teaching event. Time spent in learning about the opportunities and pitfalls will pay itself back over the next years.

Our writer started to invest in property at the start of 2017. They now own five properties, one house and four flats bringing in an annual rent of £36,000. All of them needed to be completely refurbished, literally taking walls back to brickwork, replacing complete heating systems and household electrical circuits.

They attended training with Elite Legacy before and during these purchases and admit they would not have been able to move so quickly without the expert advice provided.